rhode island tax rates 2020

1 Rates support fiscal year 2020 for East Providence. Delivery Spanish Fork Restaurants.

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

. Rhode Island Tax Rates 2020. Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350 639413 599 over 148350. The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Rhode Island Department of Revenue website.

Find your gross income 4. Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land 3470 - apartments with six or more units. We separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Both the state income and sales taxes are near national averages. Tax Year Status Amount 2020. Restaurants In Matthews Nc That Deliver.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. Rhode Island Estate Tax. Find your income exemptions 2.

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. 2020 Rhode Island Tax Deduction Amounts. The Rhode Island Income Tax Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Soldier For Life Fort Campbell. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax Counties and cities are not allowed to collect local sales taxes. The rates range from 375 to 599.

Rhode Island also has a 700 percent corporate income tax rate. Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount 25200 25250 946 25250 25300 948 25300 25350 950 25350 25400 952.

That number has fallen considerably to. The state does tax Social Security benefits. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with. 7 State Taxes 0 Average local tax 7 Combined Tax Property Taxes. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table 1.

The tax breakdown can be found on the Rhode Island Department of Revenue website. 2021 Rhode Island Standard Deductions The Rhode Island standard deductions has increased for Tax Year 2021. Income Tax Rate Indonesia.

Now may be the perfect time to purchase a home in one of those areas. 15 15 to 20 20 Click tap or touch markers on the map below for more detail. In 2020 the property tax rate for Exeter was 1557.

Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay 375 For earnings between 6525000 and 14835000 youll pay 475 plus 244688 For earnings over 14835000 youll pay 599 plus 639413.

Everything You Need to Know - SmartAsset The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and aboveThe federal estate tax may also apply on top. The income tax is progressive tax with rates ranging from 375 up to. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. The chart below breaks down the Rhode Island tax brackets using this model. Rhode Island Property Tax Rates for 2020 tax rate per thousand dollars of assessed value Click table headers to sort Tax Rates Markers.

1 Unemployment Insurance 2 Job Development Fund and 3 Temporary Disability Tax. Find your pretax deductions including 401K flexible account contributions. Essex Ct Pizza Restaurants.

4 the tax rates applicable to class 4 for fiscal year 2020 the rate of taxation shall be. Besides the state income tax The Ocean State has three additional state payroll taxes administered by the Division of Taxation. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax 5.

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Sales Taxes Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Rhode Island. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

Rhode Island Municipalities Where Property Tax Rates Are Falling. 2 Municipality had a revaluation or statistical update effective 123119. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

41 rows 2989 - two to five family residences 3243 - commercial I and II industrial commind. Opry Mills Breakfast Restaurants. On the flip side you will also find municipalities in Rhode Island where the property tax rates are trending down.

Rhode Island State Economic Profile Rich States Poor States

Where S My Rhode Island State Tax Refund Taxact Blog

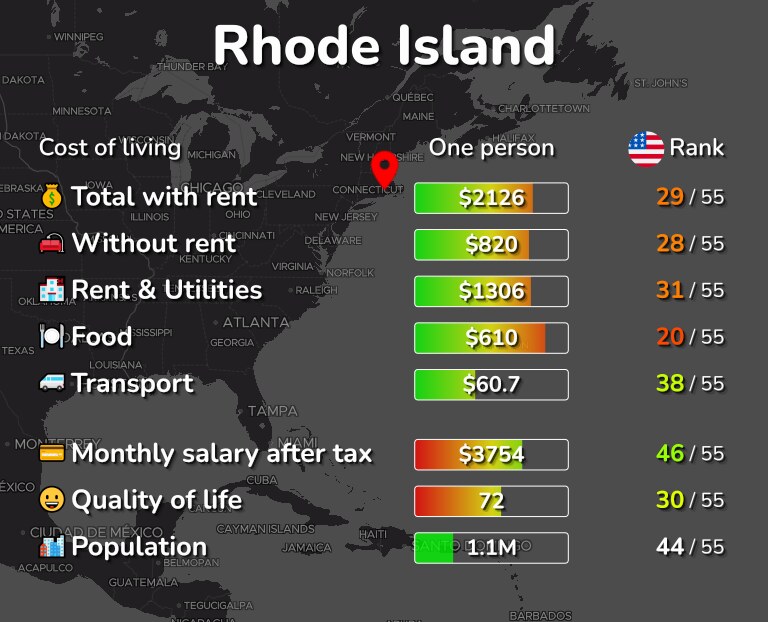

Cost Of Living Prices In Rhode Island 18 Cities Compared

Rhode Island Income Tax Calculator Smartasset

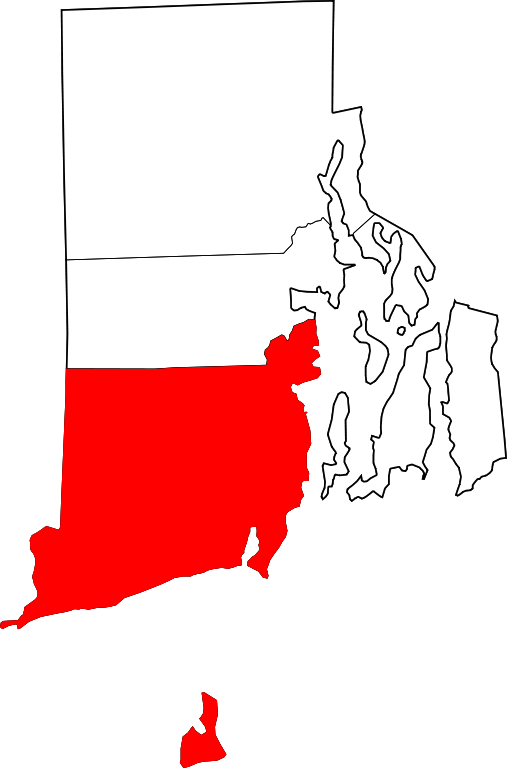

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Rhode Island Income Tax Brackets 2020

Opinion Dibiase Hiking Personal Income Taxes In Ri Will Hurt Economy

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Climate Change In Rhode Island Wikipedia

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Find Craft Shows In Rhode Island 2019 2020 Festivalnet Com Island Crafts Island Crafts

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040